Contents

. government in 2017 reduced the amount borrowers age 62 and older can draw from their home equity for its Home equity conversion mortgage (hecm) and raised that loan’s premiums. Now, a handful of.

How Does A Reverse Mortgage Really Work The CHIP Reverse Mortgage Process is Easy. 1 Estimate Find out how much money you can get with a free estimate. 2 Review Our consultants and specialist will contact you to verify your information and answer question. 3 Receive Receive the money you need in one lump sum or multiple installments. 4 Payment There are no monthly mortgage payments.

A Home Equity Conversion Mortgage (HECM) for Purchase is a reverse mortgage that allows seniors, age 62 or older, to purchase a new principal residence using loan proceeds from the reverse mortgage. real estate professionals who are interested in learning more about HECM for Purchase can download free resources from NRMLAonline.org

FHA insures a reverse mortgage known as HECM. Reverse mortgages allow homeowners to convert equity in their homes into income that can be used to pay for home improvements, medical costs, living expenses, or other expenses. The equity that the homeowner builds up over years of making mortgage payments can be paid to the homeowner.

While the Home Equity conversion mortgage (hecm) program‘s estimated 2020 impact to the federal budget deficit is seen as negligible, according to recent analysis by the Congressional Budget Office,

You will pay an origination fee to compensate the lender for processing your HECM loan. A lender can charge the greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of the amount over $200,000. HECM origination fees are capped at $6,000. Servicing Fee Lenders or their agents provide servicing throughout the life of the HECM.

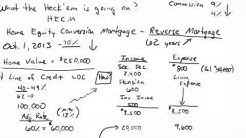

A Home Equity Conversion Mortgage (HECM) loan – also known as a reverse mortgage – can be an important financial option for seniors, their family members, and financial professionals to consider as part of an overall retirement planning strategy or to help meet cash flow needs.

An FHA reverse mortgage, also known as a Home Equity Conversion Mortgage (HECM), is a loan insured by the united states federal government.. After the Great Depression, the United States Congress passed the National Housing Act of 1934 with the purpose of making homes and mortgages.

By taking what are often considered the shortcomings associated with the Home Equity Conversion Mortgage (HECM) program and turning them into benefits for new proprietary products, representatives of.

Home Equity Conversion Loan Reverse Mortgage Amortization Schedule Excel Using U.S. Census Bureau data, we weighed median home values and monthly homeownership costs, including mortgage payments. And the town’s new 4 million gallon water storage tank is on schedule to.Sell the home themselves to settle up the loan balance (and keep the remaining equity). Allow the lender to sell the home (and the remaining equity is distributed to the borrowers or heirs). The HECM reverse mortgage is a non-recourse loan, which means that the only asset that can be claimed to repay the loan is the home itself. If there’s not.

NRMLA Calculator Disclosure. Please note: This reversemortgage.org calculator is provided for illustrative purposes only. It is intended to give users a general idea of approximate costs, fees and available loan proceeds under the FHA Home Equity Conversion Mortgage (HECM) program.

NRMLA Calculator Disclosure. Please note: This reversemortgage.org calculator is provided for illustrative purposes only. It is intended to give users a general idea of approximate costs, fees and available loan proceeds under the FHA Home Equity Conversion Mortgage (HECM) program.

How To Purchase A Home With A Reverse Mortgage “We are confident our new team will be energized by our people-first culture, and our new customers will benefit from our user-friendly mobile and online tools designed to help them manage their home.