Contents

Average Interest On Business Loans The following table provides interest rates for Direct Loans and Federal Family Education loan (ffel) program loans 1 first disbursed on or after July 1, 2006, and before July 1, 2019. Perkins Loans (regardless of the first disbursement date) have a fixed interest rate of 5%.

Suppose a bank loans a person $200,000 to purchase a house at a rate. A nominal interest rate refers to the interest rate before taking inflation into account. To calculate the real interest rate,

Looking for an auto loan calculator? Bankrate.com can help you calculate the monthly payments on your next new or used auto loan.

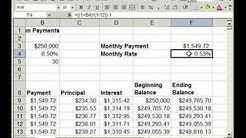

Average Mortgage Payment For 300 000 If you borrow 200,000 at 5.000% for 30 years, your monthly payment will be $1,073.64.. The payments on a fixed-rate mortgage do not change over time. The loan amortizes over the repayment period, meaning the proportion of interest paid vs. principal repaid changes each month.

The point is, does the property agent know which bank package is good for you? Do they know how to calculate your loan.

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could.

Bankrate Cd Rates 5 Year Here are the nationally available best CD rates updated daily. Compare these high yield CD rates with confidence because we’re constantly searching the country for the best certificate of deposit interest rates and savings investments.

Bank term loans typically have long repayment. you’d make fixed monthly payments of $2,649 and pay total interest and fees of $58,963. Use NerdWallet’s business loan calculator to figure out the.

Loan. calculator. fast cash: onemain provides fast loans; you can complete an application and receive a decision in less than 10 minutes. Once you’ve been approved, you can receive funds as soon as.

This personal loan calculator can help you see how different interest rates and fees can impact your costs. Our calculator asks for the APR, which reflects all.

HDFC’s EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the effect of the tenure and interest rates. emi calculator also provides an amortization table elucidating the repayment schedule. HDFC’s home loan calculator provides a complete break-up of the interest and principal amount.

The APR on the Alpha Mortgage loan is 5.00%, but the APR on the Beta Mortgage loan is 5.02%. To calculate. the same interest rate, it stands to reason that lenders and borrowers will pick the more.

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could.

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could.

Increasing the interest rate or loan amount will increase your EMI, while increasing the tenure will reduce the EMI. Adjust the variables according to your requirement. Is this calculator only for HDFC Bank personal loans? You can use the calculator to calculate the EMI on a personal loan from any bank or financial institution. It is free to.